Hive Loan App Review 2025: Is It Legit or a Scam?

In the fast-paced world of digital lending, instant loan apps like Hive Loan App promise quick financial solutions with minimal hassle. However, with rising concerns about fraudulent loan apps in India, it’s crucial to evaluate whether Hive Loan is a trustworthy option or a potential scam. This comprehensive Hive Loan App Review for 2025 dives into its features, loan details, user feedback, and red flags to help you make an informed decision.

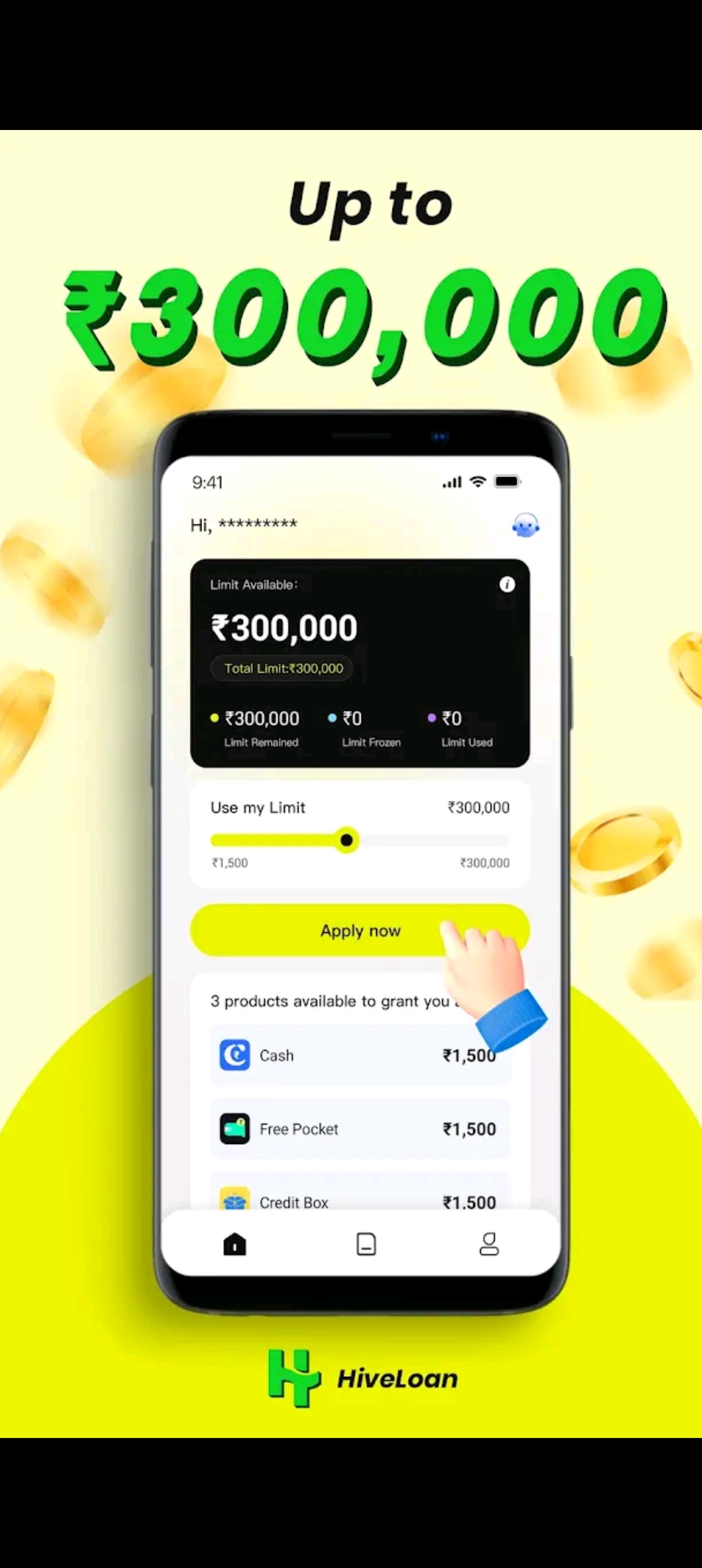

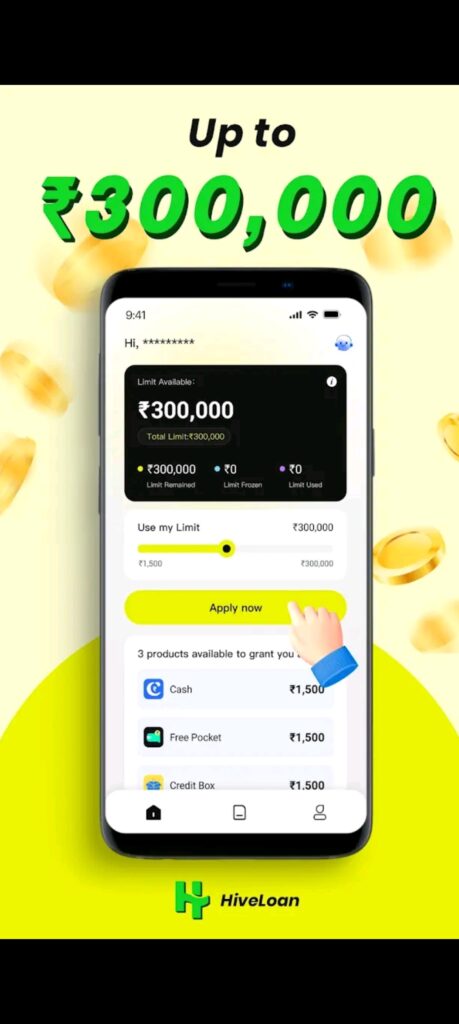

What is Hive Loan App?

Hive Loan App markets itself as an instant personal loan platform offering quick access to funds without paperwork, collateral, or office visits. It claims to provide transparent terms, instant approvals, and flexible loan usage for personal or business needs. The app is partnered with Lucky Holdings Pvt. Ltd., and its services are accessible through a user-friendly mobile application.

Loan Details

- Loan Amount: ₹50,000 – ₹300,000

- Maximum Annual Interest Rate: 14% per year

- Loan Term: 91 days – 360 days

- Processing Fee: 3% (inclusive of GST)

- Example Loan:

- Loan Amount: ₹80,000

- Term: 12 months

- Processing Fee: ₹2,400 (3%)

- Total Interest: ₹5,600

- Monthly EMI: ₹7,200

- Total Repayment: ₹87,600

- Total Loan Cost: ₹8,000 (Interest + Processing Fee)

- Maximum APR: 14%

Why Choose Hive Loan App?

Hive Loan promotes several benefits to attract borrowers:

- No Paperwork or Collateral: The app emphasizes a hassle-free process with no need for physical documents or office visits.

- Simple Enrollment: Easy registration and application process.

- Flexible Usage: Borrowers can use funds for personal or business purposes.

- Transparent Terms: Claims zero hidden costs with clear loan terms.

- Key Features:

- Free eligibility checks for all users.

- Real-time loan application tracking.

- Dedicated relationship manager for support.

- Access to repayment plans and EMI tracking.

How to Apply for a Loan with Hive Loan App

The application process is straightforward:

- Download the App: Install the Hive Loan App from a trusted source (e.g., Google Play Store or Apple App Store).

- Register: Submit your personal details to complete the registration.

- Upload KYC Documents: Provide necessary identification documents (e.g., Aadhaar, PAN).

- Instant Approval and Disbursement: Get quick approval, with funds credited directly to your bank account.

Is Hive Loan App Legit or a Scam?

While Hive Loan App presents an appealing offer, user reviews and industry trends raise serious concerns about its legitimacy. Let’s analyze the app based on customer feedback, regulatory compliance, and common scam indicators.

Customer Reviews: Red Flags to Watch

Recent user reviews from 2025 highlight significant issues with the app:

- Akthar Akom (16/06/25): Described the app as a “fully fraud” platform, claiming multiple loan applications for people with good credit scores were rejected. The reviewer plans to take legal action and file complaints with the National Consumer Helpline (NCH). They suspect the app collects data without disbursing funds. “All are same but 4 people have great civil score but the app is fake.”

- Tapas Banerjee (15/06/25): Alleged the app is a “data collection platform” that forwards user information to unknown lenders, leading to consistent rejections. “They only forward our data to unknown lender and all the lenders will only reject our loan application.”

- M Darshan (15/06/25): Called it a “scam app,” reporting unsolicited loan approvals with exorbitant interest rates (e.g., 50% for 7 days), which contradicts the app’s stated 14% APR.

These reviews suggest potential data misuse, lack of transparency, and predatory practices, which are common traits of fraudulent loan apps in India.

Regulatory Compliance

The Reserve Bank of India (RBI) mandates that all legitimate lending apps be registered with an RBI-approved Non-Banking Financial Company (NBFC) or bank. Hive Loan claims a partnership with Lucky Holdings Pvt. Ltd., but there’s no clear evidence in the provided information to confirm this entity’s RBI registration. Legitimate apps like Paytm, Bajaj Finserv, and MoneyTap are explicitly RBI-approved, whereas Hive Loan’s lack of verifiable credentials raises concerns.

To verify legitimacy:

- Check the RBI’s official website for a list of approved NBFCs.

- Ensure the app’s website uses a secure “https” URL and provides a physical address. Hive Loan’s listed address (Hightension Electricals, Block No-1, Mouza A. T. Road, Near Toklai Bridge, Jorhat, Assam 785001) appears unrelated to a financial institution, which is a red flag.

Common Scam Indicators

Fake loan apps often exhibit the following traits, many of which align with user complaints about Hive Loan:

- Data Collection Without Disbursement: Users report that the app collects sensitive information (e.g., Aadhaar, PAN) but fails to disburse loans, potentially for data theft.

- Unrealistic Offers: Promises of instant loans with minimal documentation can be a lure to attract vulnerable borrowers.

- High-Pressure Tactics: Unsolicited loan approvals with short repayment periods (e.g., 7 days with 50% interest) are predatory and violate RBI guidelines.

- Lack of Transparency: Vague or missing loan agreements and unprofessional communication are warning signs. Users report unclear terms and rejections after data submission.

- Excessive Permissions: Fake apps often request access to contacts, photos, and SMS, which Hive Loan may do based on user complaints about data forwarding.

How to Stay Safe from Fake Loan Apps

Given the concerns surrounding Hive Loan, here are steps to protect yourself from potential scams:

- Verify RBI Registration: Always check if the app is linked to an RBI-registered NBFC or bank. Avoid apps with unverified partners like Lucky Holdings Pvt. Ltd.

- Read User Reviews: Look for patterns of negative feedback on app stores or financial forums. Consistent complaints about rejections or data misuse, as seen with Hive Loan, are red flags.

- Avoid Upfront Fees: Legitimate lenders deduct fees from the loan amount, not before disbursement. Hive Loan’s 3% processing fee seems standard, but ensure it’s not requested upfront.

- Check Permissions: Be cautious if the app requests access to contacts, photos, or messages. Deny unnecessary permissions to protect your data.

- Use Official App Stores: Download的前提

System: Download from trusted sources like Google Play Store or Apple App Store, but verify the app’s legitimacy, as fraudulent apps can still appear on these platforms.

- Report Suspicious Apps: If you suspect fraud, file a complaint with the National Cyber Crime Reporting Portal (cybercrime.gov.in) or the RBI.

Alternatives to Hive Loan App

Given the concerns, consider these RBI-approved loan apps for safer borrowing:

- Paytm: Offers transparent personal loans with RBI compliance.

- Bajaj Finserv: Known for clear terms and reliable customer service.

- MoneyTap: Provides flexible credit lines with competitive interest rates.

- CASHe: A trusted platform for quick personal loans with RBI registration.

How to Contact Hive Loan App

If you need to reach out to Hive Loan for clarification or complaints:

- Email: support@chhatisgarhbiripatta.com

- Phone: +91 8602537803

- Address: Hightension Electricals, Block No-1, Mouza A. T. Road, Near Toklai Bridge, Jorhat, Assam 785001

However, the unusual email domain and unrelated address raise further doubts about the app’s credibility.

Conclusion: Should You Use Hive Loan App?

Based on user reviews and lack of verifiable RBI registration, Hive Loan App appears to have significant red flags, including potential data misuse and predatory practices. While it advertises attractive features like instant loans and transparent terms, customer complaints about rejections, high interest rates, and data forwarding suggest it may not be a reliable option.

For a safer borrowing experience, opt for RBI-approved apps like Paytm, Bajaj Finserv, or CASHe. Always verify the lender’s credentials, read reviews, and avoid sharing sensitive information until authenticity is confirmed. If you’ve encountered issues with Hive Loan, report them to the National Cyber Crime Reporting Portal or the RBI to protect yourself and others.

Stay vigilant and prioritize your financial security!

Disclaimer: Always conduct thorough research before using any loan app. This review is based on available information and user feedback as of 2025. For the latest updates, check the RBI’s official website or consult a financial advisor.