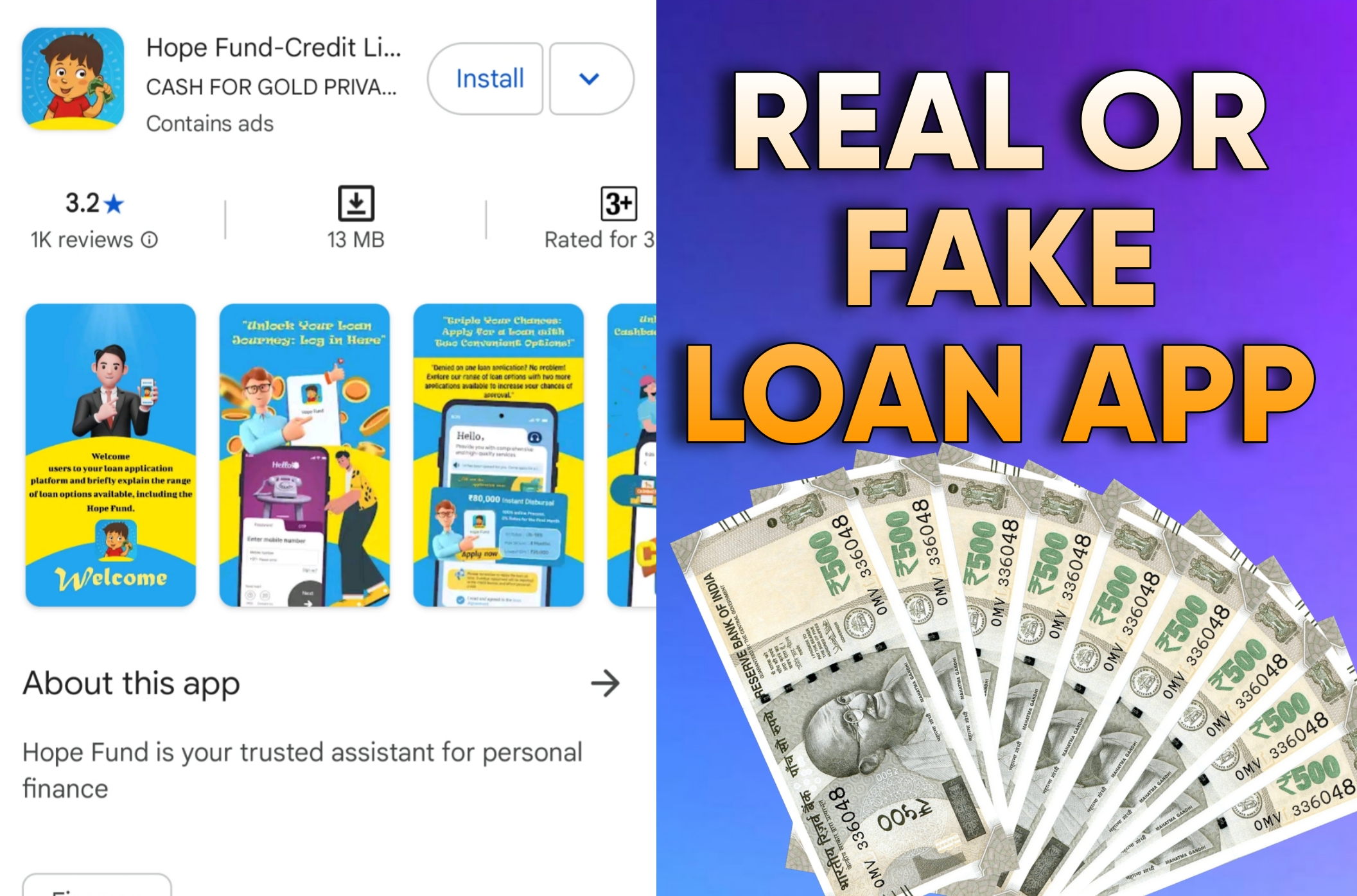

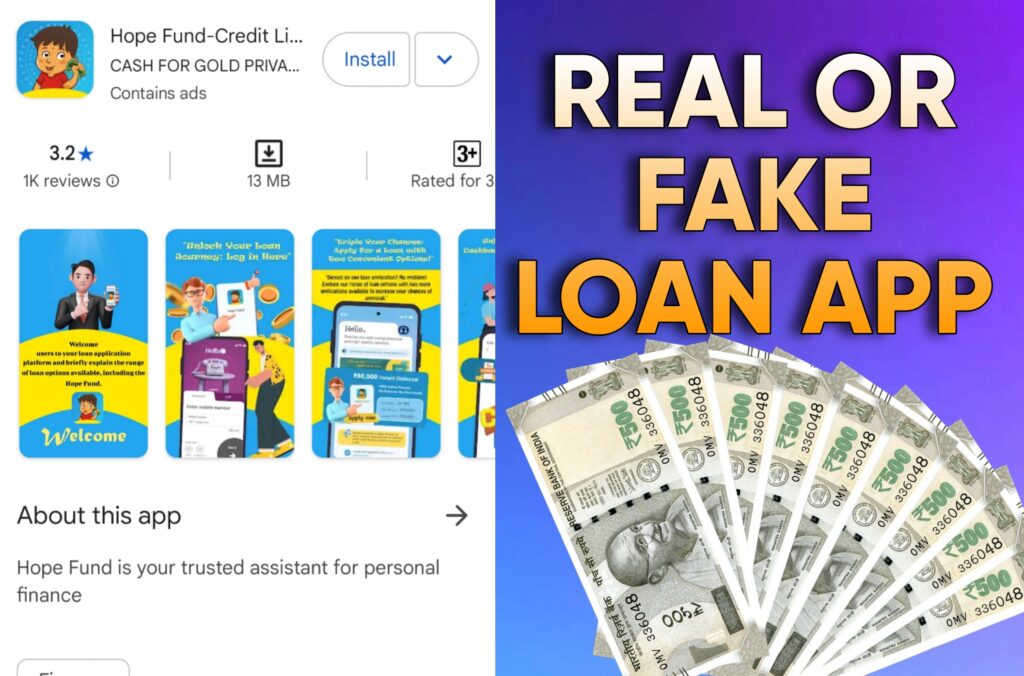

In today’s fast-paced world, quick access to personal loans through mobile apps has become a lifeline for many. Among the plethora of loan apps available on the Google Play Store, Hope Fund positions itself as a reliable and convenient solution for personal finance.

With promises of rapid loan approvals, minimal paperwork, and nationwide accessibility, it aims to attract users looking for short-term financial assistance. But does it live up to its claims? Based on the app’s official description and real user reviews, this comprehensive review dives deep into what Hope Fund offers, its hidden pitfalls, and whether it’s worth your trust.

What is Hope Fund Loan App?

Hope Fund is a short-term personal loan app that collaborates with an RBI-registered Non-Banking Financial Company (NBFC), Vaishali Securities Limited, to provide lending services. According to its Play Store description, the app is designed to offer seamless, secure, and convenient loan solutions for individuals facing urgent expenses or planned investments. It markets itself as a user-friendly platform with features like 24/7 accessibility, rapid loan approvals within 30 minutes, and minimal documentation.

The app claims to cater to a wide audience across India, requiring only basic eligibility criteria such as Indian citizenship, a valid Aadhaar card, a PAN card, and a favorable credit history. With loan amounts ranging from ₹5,000 to ₹80,000, tenures of 3 to 12 months, and an APR (Annual Percentage Rate) of 0% to 18.25%, Hope Fund appears to be a flexible option for those in need of quick funds.

However, user reviews paint a starkly different picture, raising red flags about transparency, hidden charges, and questionable practices. Let’s take a closer look at what Hope Fund promises and how it performs in reality

Key Features of Hope Fund Loan App

- Loan Details:

- Amount: ₹5,000 to ₹80,000Tenure: 3 to 12 months

- Interest Rate: 0.05% per day (translating to an APR of up to 18.25%)

- Example: For a ₹50,000 loan for 4 months at 0.05% daily interest, the total interest is ₹3,000, making the repayment amount ₹53,000.

- Eligibility Criteria

- Indian citizen

- Age 18 or above

- Valid Aadhaar and PAN card

- Favorable credit history

- User-Friendly Process:

- Download the app, sign up, and verify identity.Select loan type and submit details.

- Get approval within 30 minutes.

- Receive funds directly in your bank account.

- Repay through the app for hassle-free management.

- Why Choose Hope Fund?:

- 24/7 Accessibility: Apply for loans anytime, anywhere.

- Minimal Paperwork: Only Aadhaar, PAN, and a selfie are required.Rapid Approvals:

- Loan approvals in as little as 30 minutes.No Hidden Costs: Claims zero upfront or membership fees.

- Nationwide Reach: Available across India.

- Customer Support:Email: hr@cashforgoldpvt.comPhone: +91 9611713129

- Address: Wadhwa IIA – 12, Lajpat Nagar South, New Delhi – 110024, India

User Reviews: The Dark Side of Hope Fund

While Hope Fund markets itself as a trustworthy financial partner, user reviews on the Play Store tell a troubling tale. Many borrowers have reported issues with transparency, exorbitant charges, and poor customer service. Below is a summary of common complaints based on real user feedback

- Hidden Charges and Discrepancies in Disbursal:

- Users like Sufi Rahat Malik and Mohan Krishna reported receiving significantly less than the approved loan amount.

- For instance, a ₹4,000 loan resulted in only ₹2,800–₹2,960 credited to their accounts, yet they were asked to repay ₹4,200–₹4,280.The difference is attributed to processing fees or other charges, which are not clearly disclosed upfront.

- High Interest Rates:

- The app’s daily interest rate of 0.05% may seem small, but it adds up quickly. For a ₹4,000 loan, users ended up paying over 40% more than the disbursed amount within a short repayment period (e.g., 13–15 days).This suggests that the effective interest rate is much higher than the advertised APR of 0%–18.25%.

- Lack of Transparency:

- Users like Ansh Sky complained about funds being credited without explicit consent or clear communication. In some cases, users received money after merely exploring the app, only to be asked to repay a much higher amount.EMI payments were not updated correctly, causing confusion and additional stress.

- Poor Customer Support:

- Multiple users, including Sufi Rahat Malik, reported that the grievance email (hr@cashforgoldpvt.com) was unresponsive. Contact information provided in the app was either non-functional or led to no resolution.This lack of support left borrowers feeling trapped and helpless.

- Potential Scam Allegations:

- Reviews from THARIF TA and others label the app as a “complete scam,” citing discrepancies between the loan amount disbursed and the repayment demanded.Some users even threatened to file complaints with authorities due to the app’s questionable practices.

These reviews highlight a significant gap between Hope Fund’s promises and its actual performance. While the app may be backed by an RBI-registered NBFC, its practices raise serious concerns about fairness and transparency.

Pros and Cons of Hope Fund Loan App

To provide a balanced perspective, let’s weigh the advantages and disadvantages of using Hope Fund based on its description and user feedback.

- Pros:

- Quick Approvals: Loans are approved within 30 minutes, making it suitable for emergencies.

- Minimal Documentation: Only Aadhaar, PAN, and a selfie are required, simplifying the application process.

- Nationwide Availability: Accessible across India, catering to a broad audience.

- RBI-Registered Partner: Collaboration with Vaishali Securities Limited adds a layer of legitimacy.

- Cons:

- Hidden Charges: Significant deductions from the disbursed amount due to processing fees or other costs.

- High Interest Rates: The effective interest rate is much higher than advertised, leading to costly repayments.

- Lack of Transparency: Unclear terms and unexpected fund transfers confuse users.

- Poor Customer Support: Unresponsive or non-functional grievance channels leave users stranded.

- Scam Allegations: Numerous reviews label the app as fraudulent, eroding trust.

Is Hope Fund Safe to Use?

Given the user feedback, Hope Fund appears to be a risky choice for borrowers. While it operates under the umbrella of an RBI-registered NBFC, its practices—such as deducting large fees, charging high interest rates, and failing to provide adequate customer support—raise serious concerns. The app’s lack of transparency and allegations of unauthorized fund transfers further erode its credibility.

If you’re considering Hope Fund, proceed with caution. Here are some tips to protect yourself:

- Read the Fine Print: Carefully review the loan agreement for hidden fees and charges.

- Check Reviews: Look beyond the Play Store description and read user reviews on multiple platforms.

- Contact Support First: Test the customer support channels before applying for a loan.

- Borrow Only What You Need: Avoid taking loans unless absolutely necessary, given the high repayment costs.

- Explore Alternatives: Compare Hope Fund with other reputable loan apps or traditional lenders for better terms.

FAQs About Hope Fund Loan App

- 1. Is Hope Fund a legitimate loan app?

- Hope Fund collaborates with an RBI-registered NBFC, Vaishali Securities Limited, which lends it some legitimacy. However, user reviews highlight issues like hidden charges, high interest rates, and poor transparency, raising concerns about its trustworthiness.

- 2. What are the eligibility criteria for a Hope Fund loan?

- You must be an Indian citizen, aged 18 or above, with a valid Aadhaar card, PAN card, and a favorable credit history.

- 3. How much can I borrow from Hope Fund?

- The app offers loans ranging from ₹5,000 to ₹80,000 with tenures of 3 to 12 months.

- 4. What are the interest rates charged by Hope Fund?

- The app advertises a daily interest rate of 0.05%, translating to an APR of 0%–18.25%. However, user reviews suggest the effective interest rate can be much higher due to additional fees.

- 5. Why do users receive less than the approved loan amount?

- Many users report receiving only 70%–75% of the approved amount due to processing fees or other deductions, which are not clearly disclosed upfront.

- 6. How can I contact Hope Fund customer support?

- You can reach out via email (hr@cashforgoldpvt.com) or phone (+91 9611713129). However, users have reported that these channels are often unresponsive.

- 7. Is Hope Fund safe for borrowing?

- While the app is tied to an RBI-registered NBFC, user complaints about hidden charges, high repayment demands, and poor customer support suggest it may not be a safe choice. Proceed with caution and explore alternatives.